Making money in the stock market requires an investor to be contrarian and challenge the market’s conventional wisdom. Unlike US markets which are very efficient, it’s still relatively easy to find inefficiencies in the Indian market’s behavior. The returns generated are proportionate to the number of successful contrarian calls you’ve made. If you only buy the market darlings, then your returns will reflect that of the market average. There will be no significant alpha creation. Some investors hold the view that technology has democratized access to information. Unlike previous eras, where the investor’s edge over his peers in the markets was informational and analytical, today they believe the investor’s edge is largely behavioral. Twitter and apps like WhatsApp and Telegram spread news like wildfire. While I do believe that there is some merit in this argument, I also believe that it ignores the fact that institutional accumulation which is the biggest driver of stock returns takes time and does not happen instantly upon receiving a WhatsApp notification. Hot retail money may lead to a 5-10% increase in the pricing but if you’re looking for multibagger returns that is only possible when big institutions buy your stock. It is here where we as investors should take advantage of the lag between spread of news and actual institutional action.

Going against common wisdom demands having a different view called variant perception, conviction and patience. Here are some of the factors where one can develop an independent view different from the markets:

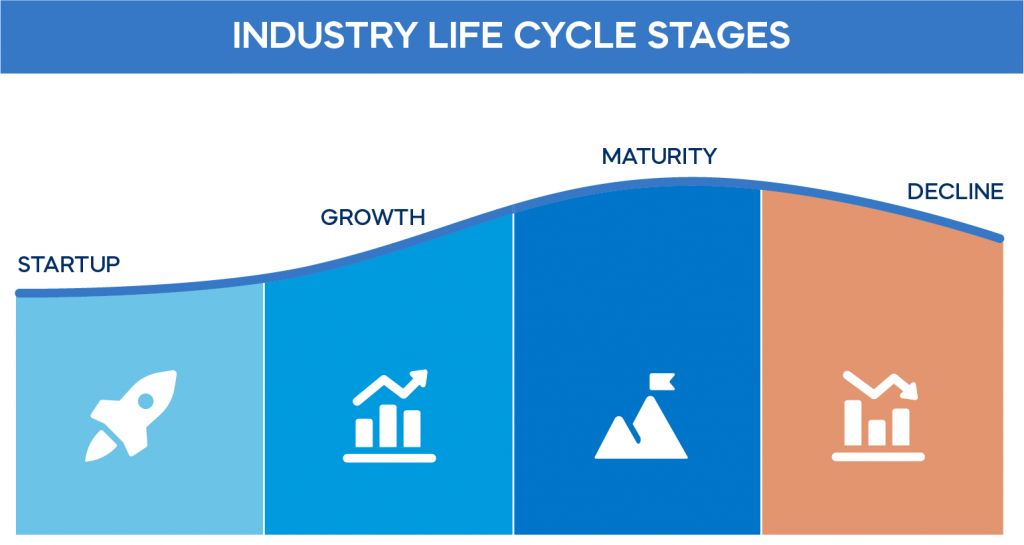

Industry cycle

All industries go through cycles. Commoditized ones are heavily cyclical with sharp booms and busts while the cycle in FMCG is more of a generational thing caused due to change in customer preference or economic slowdown or product obsolescence. Either way, the standard deviation of boom and bust are much lesser in FMCG (even though they do exist). As investors, we can make money by identifying the correct stage of the industry cycle before it is priced in by the market. This gets priced in by the market when big institutions start getting involved.

Product mix change

A company could have recently commissioned a new product line or taken a short term sales hit due to a product mix change (which could be rewarding in the long term). It is here where the market can be short-sighted and fail to understand that product mix change could generate tremendous value for the company. The market will often wait for actual numbers to back the optimism, and it is here where the investor can beat the market by buying early at the right time.

Margin expansion

Margin expansion can happen due to change in product mix, volume, pricing, costs, technology etc. The key variant perception here is doing your research well and buying companies who are undergoing a silent transformation transitioning from being a low margin to high margin producer. If you’re able to ride this dramatic change, you can make a lot of money as markets have a tendency to give higher multiples to companies with higher margins. This is because higher margins enable greater cash flows and more room for safety.

Promoter/Management change

New, aggressive, funded, disciplined and experienced management can transform the fortunes of a company and help it move to the big leagues. Managements play an outsized role in determining the future course and hence when you’re betting on a company, you’re really betting on the promoter/management’s drive, vision and execution capability. Markets may not fully realize the gravity of the change which the new team might herald. Hence, taking a bet in such situations can be very rewarding.

Cost reduction

Sale of loss making or closure/downsizing of lower margin units or change in manufacturing process or finding alternate suppliers or reducing overall advertising expenses can all lead to lower operational costs and improved profitability. However, a word of caution is warranted here investors need to study and analyze if the company’s cost reducing efforts will lead to a one-off increase in income or a sustained improvement. This is because some costs could come back to haunt the company when faced with rising competition (eg. Advertising costs), so investors should be cognisant of this and factor it into their calculation of payoffs.

Deleveraging

Companies could be shedding debt to reduce their interest burden and make their operations more profitable. This is especially important in an era of rising interest rates. In general, markets love debt free or minimal debt companies because their cash flows are so robust that taking on debt becomes a strategic choice and not a necessary condition for growth. Investors can research and find companies that are determined to reduce their debt and buy it before they become completely debt free.

Capex

There is usually a minimum gap of 18-24 months between greenfield capex announcement and commissioning of the same. Then it could take another 12 months to get the required approvals and for capacity utilization to ramp up. Companies also share expected asset turnover from the capex. So investors get plenty of time to buy the company, increase their stake as capacity ramp up happens and enjoy when sales figures go up massively. There can also be a brownfield capex announcement which unlike greenfield is basically an extension of current facilities. Brownfield capex has shorter lead times and here investors need to be quicker to take advantage.

Demerger

Demergers are often mispriced as the market generally fumbles in figuring out the odds and payoffs to be offered. Timing the entry and exit is of essence and investors can make a lot of money out of it. Often the demerged company is available at a throwaway price either due to forced institutional selling or retail investors cashing out, if fundamentally the entity is solid, then one should buy and take advantage of a temporary fall which will very likely be reversed soon.

Corporate actions

Corporate actions can be of various types: dividends, bonus issue, buybacks, M&A, delisting, QIPs etc. There is no fixed template and the investor must analyze each corporate action on its own merits and decide if the action is being reflected in market prices or not and is it beneficial for the shareholders. Accordingly, the investor can decide his course of action and see if there is an opportunity to take advantage of mispricing. If the corporate action increases the intrinsic value of the company, then it can be a good buy.

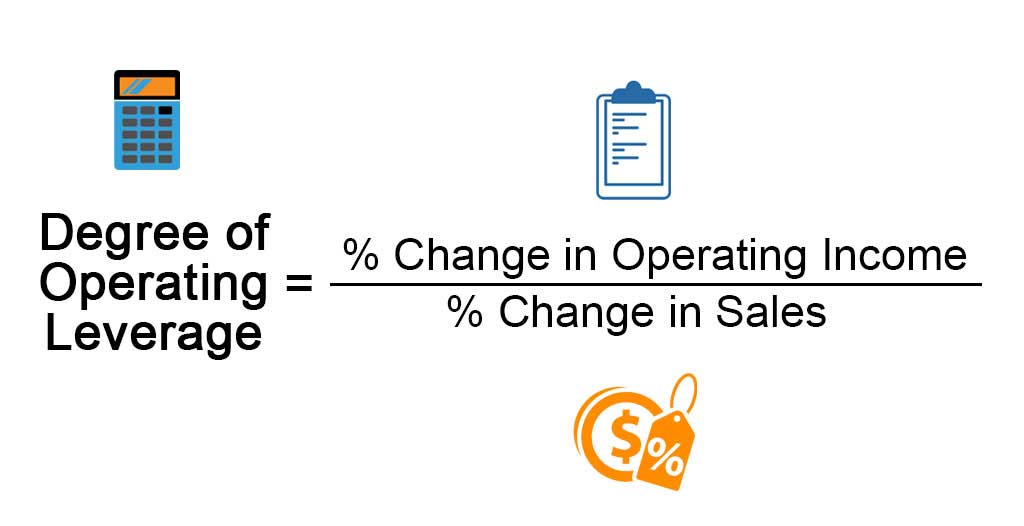

Operating leverage

Take it from me, that most investors don’t understand how Operating leverage works. The higher the fixed costs, the higher is a company’s operating leverage. This is a simple yet misunderstood fact. Having high fixed costs means that an increase or decrease in sales has a disproportionate non-linear impact on the bottom-line. Since most people don’t intuitively get this, smart investors can take advantage.

Now that you understand the factors that can help you gain an edge over the market, do check out our article on how you can gain that edge in terms of Behavior in our article Investor’s Perception: Behaviour.

Leave a Reply