Buy Price: 322

Reasons for buying:

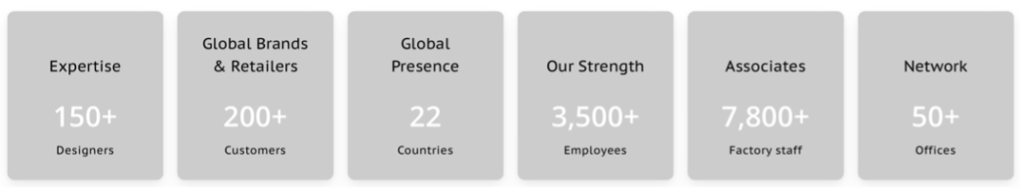

- The company is a leading fashion infrastructure company, having 5 verticals – design led sourcing, complete sourcing, brand management, manufacturing, and venture capital.

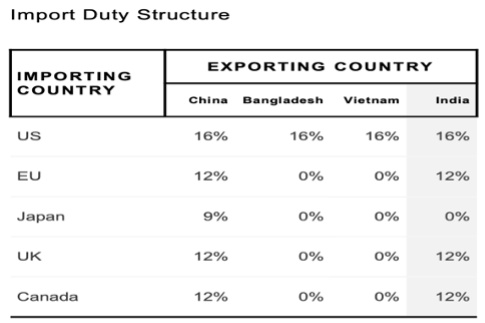

- China+1 is very visible in fashion and the wider textile industry. Western companies are actively looking for alternatives and seeking to diversify their supply chains and de-risk their business. Hence the recent boom in Bangladesh and Vietnam. As our competitiveness is rising, some of this is spilling over to India.

- Indian companies have a huge tailwind because textile industry is very labour intensive and labour supply is shrinking across China and Southeast Asia. Indian labour will peak over the next couple of decades. Made-in-India clothing is expected to rise massively in the coming years.

- The company is well diversified both in terms of client profile and operations. They work with marquee clients and have operations in India, Bangladesh, Sri Lanka etc.

Source: www.pdsltd.com

- Company is a high-quality midcap with healthy cashflows, high promoter holding, available at a great price (below 5 YR median PE).

- They place heavy emphasis on technology. Their Bangladesh factory has a high degree of automation with sustainable processes and green certification.

- Their venture capital investments are into some interesting companies with a lot of potential like Atterly (E-Commerce), M-XR (3D technology), War Paint (Men’s make up), Zwift (Virtual training) to name a few.

- Recently, they acquired Ted Baker’s design sourcing company. Now all of Ted Baker’s sourcing will be handled by them. If successful, this could set a template for similar acquisitions which are value accretive.

- Sourcing (which is asset light) forms approximately 96% of their topline with a ROCE of 48%. The sourcing model is hyper scalable.

- Any FTA that India signs with UK, Europe and Canada will be very beneficial for the industry and company.Ace investors like Mukul Agarwal and Vallabh Bhansali have minor stakes in the company.

Source: Kearney’s report on Indian textile industry

- Ace investors like Mukul Agarwal and Vallabh Bhansali have minor stakes in the company.

Risks:

- QoQ and YoY performance has been poor because of weakness in key export markets. Management has guided for a better H2, we need to be watchful of this.

- Despite their size, on a global level, their scale of operations is still low as GMV is barely US$1.5 billion. Thus, investors need to track how they compete against bigger, organized Chinese giants and win more orders from Western brands.

- Some big brands either fully manufacture in-house for quality control or outsource a small % of their production. The narrative is there will be more outsourcing due to various reasons like rising costs, shrinking labour pool, environmental compliances etc. Going forward we need to check if numbers match narratives.

- The company has a lot of moving parts given their diversified operations and global presence. As a conservative investor, you will never fully be able to ascertain all financial dealings in their different subsidiaries worldwide.

- Recession in the west will have a direct impact as fashion is a discretionary item.

Leave a Reply